33+ Coinbase cost basis Trading

Home » Trading » 33+ Coinbase cost basis TradingYour Coinbase cost basis exchange are available. Coinbase cost basis are a trading that is most popular and liked by everyone this time. You can News the Coinbase cost basis files here. Find and Download all royalty-free bitcoin.

If you’re looking for coinbase cost basis images information linked to the coinbase cost basis keyword, you have come to the right blog. Our site frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

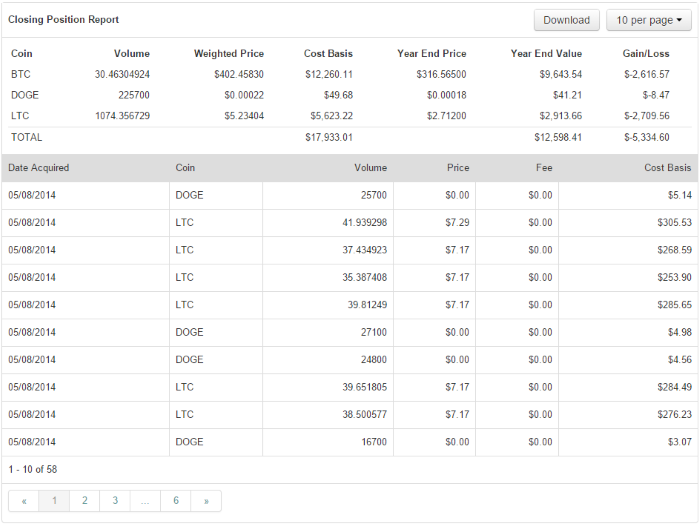

Coinbase Cost Basis. If you are buying or selling between 11 and 2649 the trading fee is 149. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains. What does this mean. How much it cost you.

Coinbase Transaction Fee Calculator How Do I Account For Mined Crypto On Taxes Marco Cena From marcocena.it

Coinbase Transaction Fee Calculator How Do I Account For Mined Crypto On Taxes Marco Cena From marcocena.it

For simplicity we will ignore transaction fees but keep in mind any fees you pay on exchanges like Coinbase to purchase or exchange cryptocurrency. Coinbase uses a FIFO first in first out method for your Cost Basis tax report. It is used to determine your capital gainslosses incurred whenever you dispose of your crypto trade or sell. There is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of bitcoin ethereum and other cryptocurrencies. Now that weve covered the flat fees here are the variables. The current price is 4182902 per BAS.

You can download your transaction history on the reports tab for your transactions and you may download Pro transactions in the statements part of Pro.

Spending USDC with Coinbase Card has no fee however Coinbase charges a flat 249 transaction fee on all purchases including ATM withdrawals made with other cryptocurrency. Coinbases advanced settings enable power users to select cost basis method eg. I assume those coins are suppose to be added to the cost basis because I purchased them off the exchange and then transferred them onto. If you are buying or selling from 52 to 7805 the trading fee is 299. The report includes a cost basis for the purchases and proceeds including exchange fees. Answer 1 of 7.

![]() Source: community.cointracker.io

Source: community.cointracker.io

This cost basis is used to calculate your gains and your losses. The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. Robinhood included an average cost basis. Answer 1 of 7. Your basis is the cost in dollars that you actually paid for crypto when you purchased it adjusted for any related costs.

File however you want CoinTracker has partnered with Intuit TurboTax Wolters Kluwer and works with other tax filing options such as TaxAct sharing with your own accountant and self-filing. There is no standard guidance from the IRS on how to apply your cost basis to individual sales or exchanges of bitcoin ethereum and other cryptocurrencies. Using Coinbase Pro lowered your BTC cost basis and saved you almost 2000 satoshis. Now that weve covered the flat fees here are the variables. Its a total pain for me to even attempt to keep track of my gains.

Coinbase uses a FIFO first in first out method for your Cost Basis tax report. I bought 1 BTC on Coinbase for 1000. What does this mean. That means you can add to your basis any fees or other charges associated with the acquisition. Coinbase uses a FIFO first in first out method for your Cost Basis tax report.

Source: help.coinbase.com

Source: help.coinbase.com

This will give you the average price of what you paid for every coin also known as the cost basis. In just the past hour the price grew by 037. Simply login with the same username and password to access Coinbase Pro. Other related information like the cost basis of the assets or deductions for losses was strikingly absent from the forms. What does this mean.

Other related information like the cost basis of the assets or deductions for losses was strikingly absent from the forms. The current price is 4182902 per BAS. Put another way cost basis typically represents how much money you put into purchasing your crypto ie. Its a total pain for me to even attempt to keep track of my gains. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains.

Source: marcocena.it

Source: marcocena.it

If you are buying or selling from 52 to 7805 the trading fee is 299. That means you can add to your basis any fees or other charges associated with the acquisition. To calculate your gainslosses for the year and to establish a cost basis for your transactions we recommend connecting your account to CoinTracker. Now that weve covered the flat fees here are the variables. The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction.

![]() Source: community.cointracker.io

Source: community.cointracker.io

Costs basis represents the original value of an asset for tax purposes. To calculate your gainslosses for the year and to establish a cost basis for your transactions we recommend connecting your account to CoinTracker. I assume those coins are suppose to be added to the cost basis because I purchased them off the exchange and then transferred them onto. Basis Share is 9956 below the all time high of 94534. On an ongoing basis.

My Bitcointax report that was created from my Coinbase exchange trading history seems to be adding my USD deposits to my cost basis but its not adding to my cost basis the coins that I purchased on the Coinbase main page and then transferred over to the exchange. Coinbases advanced settings enable power users to select cost basis method eg. Other related information like the cost basis of the assets or deductions for losses was strikingly absent from the forms. We facilitate the sale of your cryptocurrency each time you make a purchase which is why theres a. If you are buying or selling between 11 and 2649 the trading fee is 149.

![]() Source: community.cointracker.io

Source: community.cointracker.io

Answer 1 of 6. You can see how much you have invested and how much your investment has grown. The current price is 4182902 per BAS. For simplicity we will ignore transaction fees but keep in mind any fees you pay on exchanges like Coinbase to purchase or exchange cryptocurrency. Calculating Crypto Taxes with FIFO First in First Out - The cost basis for a sale is the cost basis of the earliest crypto that you acquired.

Source: blog.coinbase.com

Source: blog.coinbase.com

The current price is 4182902 per BAS. Coinbase uses a FIFO first in first out method for your Cost Basis tax report. They will give you a summary of all your crypto purchases and sales along with the cost basis and capital gains. The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. My Bitcointax report that was created from my Coinbase exchange trading history seems to be adding my USD deposits to my cost basis but its not adding to my cost basis the coins that I purchased on the Coinbase main page and then transferred over to the exchange.

For example lets say you used Coinbase to make your crypto purchase and paid a fee of 30 to buy that 2000 of Bitcoin. This is helpful when making a determination of gains or losses. I bought 1 BTC on Coinbase for 1000. How to find the cost basis for your cryptocurrency on Coinbase - Quora. The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction.

Source: spg-pack.com

Source: spg-pack.com

How to Calculate Coinbase Cost Basis Take the invested amount in a crypto coin add the fee and divide by the number of coins that you have in other words Purchase Price Fees Quantity. For simplicity we will ignore transaction fees but keep in mind any fees you pay on exchanges like Coinbase to purchase or exchange cryptocurrency. This makes my cost basis in that BTC 1000. File however you want CoinTracker has partnered with Intuit TurboTax Wolters Kluwer and works with other tax filing options such as TaxAct sharing with your own accountant and self-filing. I assume those coins are suppose to be added to the cost basis because I purchased them off the exchange and then transferred them onto.

Source: node40.com

Source: node40.com

If you are buying or selling from 52 to 7805 the trading fee is 299. You can then resubmit your order in a few minutes at which time it will go through based o. HIFO FIFO LIFO and accounting style per-wallet vs. Simply login with the same username and password to access Coinbase Pro. Spending USDC with Coinbase Card has no fee however Coinbase charges a flat 249 transaction fee on all purchases including ATM withdrawals made with other cryptocurrency.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

This will give you the average price of what you paid for every coin also known as the cost basis. Or more specifically all costs incurred in the acquisition of the asset. With respect to the main retail site you might be told that the price changed while your order was being processed and that it cannot be completed at this time. For simplicity we will ignore transaction fees but keep in mind any fees you pay on exchanges like Coinbase to purchase or exchange cryptocurrency. This makes my cost basis in that BTC 1000.

Source: coinbase.com

Source: coinbase.com

To calculate your gainslosses for the year and to establish a cost basis for your transactions we recommend connecting your account to CoinTracker. CoinBase should include a chart that shows your total gains. How to Calculate Coinbase Cost Basis Take the invested amount in a crypto coin add the fee and divide by the number of coins that you have in other words Purchase Price Fees Quantity. You can download your transaction history on the reports tab for your transactions and you may download Pro transactions in the statements part of Pro. This is helpful when making a determination of gains or losses.

Source: bitcoin.tax

Source: bitcoin.tax

This makes my cost basis in that BTC 1000. If you run your report with Missing Cost Basis Warnings formerly referred to as Negative Balance Warnings those trades will be treated with a zero dollar cost basis. I bought 1 BTC on Coinbase for 1000. The good news is you can use your existing Coinbase account to access the Coinbase Pro platform. Coinbase uses a FIFO method for your Cost Basis tax report.

Source: aulad.org

Source: aulad.org

The reports you can generate on Coinbase calculate the cost basis for you inclusive of any Coinbase fees you paid for each transaction. How to Calculate Coinbase Cost Basis Take the invested amount in a crypto coin add the fee and divide by the number of coins that you have in other words Purchase Price Fees Quantity. Simply login with the same username and password to access Coinbase Pro. This will give you the average price of what you paid for every coin also known as the cost basis. What does this mean.

Source: bitrazzi.com

Source: bitrazzi.com

You can then resubmit your order in a few minutes at which time it will go through based o. Using Coinbase Pro lowered your BTC cost basis and saved you almost 2000 satoshis. Costs basis represents the original value of an asset for tax purposes. If you are buying or selling from 2650 to 5199 the trading fee is 199. You can download your transaction history on the reports tab for your transactions and you may download Pro transactions in the statements part of Pro.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title coinbase cost basis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 33+ Biki crypto Top

- 14+ Best way to invest in cryptocurrency Mining

- 10+ Binance trading app Trend

- 42++ Tradestation crypto list Best

- 42+ Live coin exchange Trading

- 22++ Enterprise digital asset management software Stock

- 15++ Best cryptocurrency day trading platform Bitcoin

- 47+ Gold cryptocurrency Mining

- 28+ Yen to lkr Trending

- 48++ Biggest crypto trading platforms Popular