50+ Dbs digital bonds Trading

Home » Mining » 50+ Dbs digital bonds TradingYour Dbs digital bonds wallet are obtainable. Dbs digital bonds are a exchange that is most popular and liked by everyone now. You can Find and Download the Dbs digital bonds files here. News all royalty-free exchange.

If you’re looking for dbs digital bonds pictures information related to the dbs digital bonds topic, you have come to the right site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Dbs Digital Bonds. The DBS digital bond has been priced at 1135 million and comes with a six-month tenor and coupon rate of 060 annually. Multinational Singapore-based bank DBS has issued a S15 million US113 million digital bond in its first security token offering STO. FIX Marketplace is an important building block for DBS in the journey to help digitalise the capital markets in Asia. DBS is reportedly the sole bookrunner for the.

Manfaatkan Keuntungan Investasi Sukuk Bersama Dbs Treasures Dbs Bank Indonesia From dbs.id

Manfaatkan Keuntungan Investasi Sukuk Bersama Dbs Treasures Dbs Bank Indonesia From dbs.id

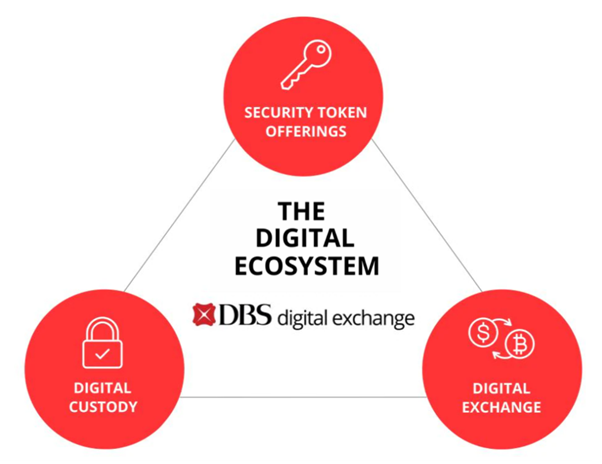

DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond. Multinational Singapore-based bank DBS has issued a S15 million US113 million digital bond in its first security token offering STO. The bonds trade on DBSs own crypto exchange the Digital Exchange DDEx which launched late last year. As with other security token offering platforms launched by institutions the first bond raises a relatively small amount of funds for DBS itself. DBS stated that this will allow other STO issuers and private clients to tap into DBS growing infrastructure to efficiently access capital markets for funding. FIX Marketplace is an important building block for DBS in the journey to help digitalise the capital markets in Asia.

DBS Bank will issue digital bonds with a maturity of 6 months and an annualized coupon rate of 06 through its Digital Exchange DDEx.

The digital bond will trade in Singapore for a whopping S10000 7600. For more information please visit. The digital bond will be traded in lots of S10000 US7600 significantly less than traditional wholesale bonds which in Singapore typically trade in multiples of S250000 US189000. The SGD 15 million 11m DBS Digital Bond has a six-month maturity carries a 06. This marks the first Security Token Offering STO on the digital exchange. Launched in December DBS Digital Exchange leverages blockchain technology to provide tokenization trading and custody for digital assets.

Source: cn.blockchain.news

Source: cn.blockchain.news

DBS Bank will issue digital bonds with a maturity of 6 months and an annualized coupon rate of 06 through its Digital Exchange DDEx. Government bonds in Singapore are known as Singapore Savings Bonds. Within these two broad classes of traditional bonds there are different sub-categories classified by their credit quality and geography. The DBS digital bond which has come with a six-month tenor and coupon rate of 060 per annum was carried out through a private placement. According to a press release shared with CoinDesk on Monday the DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon of 06 per annum.

Source: dbs.id

Source: dbs.id

As part of efforts to broaden the suite of products on the DDEx DBS announced in May that it had priced an SGD 15 million digital bond marking DDExs first Security Token Offering STO on the platform. DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond. Launched in December the DBS Digital Exchange leverages blockchain technology to provide tokenization trading and custody for digital assets. The DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon rate of 06 per annum. According to the announcement the digital bond worth 113 million will come with a six-month maturity and a coupon rate of 06 per annum.

Source: dbs.id

Source: dbs.id

According to a press release shared with CoinDesk on Monday the DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon of 06 per annum. For the next phase of development issuers will be able to issue self-led digital bonds which can be listed on the DBS Digital Exchange DDEx to provide corporates an alternate investor base to tap capital markets for their business and growth ambitions. The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of S10000 - a significantly smaller denomination compared to traditional wholesale bonds which typically require investment and trading amounts in. The bonds expire in six months and pay out 060 a year. FIX Marketplace is an important building block for DBS in the journey to help digitalise the capital markets in Asia.

Source: dbs.id

Source: dbs.id

The offering was carried out through a private placement hosted by DBS Digital. The DBS Digital Bond which is issued via DDEx comes with a six-month expiry and a coupon rate of 060 per annum. As part of efforts to broaden the suite of products on the DDEx DBS announced in May that it had priced an SGD 15 million digital bond marking DDExs first Security Token Offering STO on the platform. The digital bond will trade in Singapore for a whopping S10000 7600. DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond.

Source: dbs.id

Source: dbs.id

DBS is reportedly the sole bookrunner for the. For the next phase of development issuers will be able to issue self-led digital bonds which can be listed on the DBS Digital Exchange DDEx to provide corporates an alternate investor base to tap capital markets for their business and growth ambitions. The digital bond will be traded in lots of S10000 US7600 significantly less than traditional wholesale bonds which in Singapore typically trade in multiples of S250000 US189000. And DBS Bank is the only book-runner for this transaction. Multinational Singapore-based bank DBS has issued a S15 million US113 million digital bond in its first security token offering STO.

Source: unlock-bc.com

Source: unlock-bc.com

The DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon rate of 06 per annum. Multinational Singapore-based bank DBS has issued a. On 31 May 2021 DBS the largest bank in Singapore launched a S15 million digital bond on the DBS Digital Exchange by private placement. DBS Bank will issue digital bonds with a maturity of 6 months and an annualized coupon rate of 06 through its Digital Exchange DDEx. As part of efforts to broaden the suite of products on the DDEx DBS announced in May that it had priced an SGD 15 million digital bond marking DDExs first Security Token Offering STO on the platform.

Source: tokeny.pl

Source: tokeny.pl

Government bonds in Singapore are known as Singapore Savings Bonds. FIX Marketplace is an important building block for DBS in the journey to help digitalise the capital markets in Asia. The DBS digital bond which has come with a six-month tenor and coupon rate of 060 per annum was carried out through a private placement. The DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon rate of 06 per annum. The DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon rate of 06 per annum.

Source: pinterest.com

Source: pinterest.com

DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond. DBS stated that this will allow other STO issuers and private clients to tap into DBS growing infrastructure to efficiently access capital markets for funding. According to the banks press release DBS digital bonds issued through the Digital Exchange DDEx have a maturity of six months and a coupon. DBS is reportedly the sole bookrunner for the. The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of 10000 - a significantly smaller denomination compared with.

Source: pinterest.com

Source: pinterest.com

This marks the first Security Token Offering STO on the digital exchange. According to the announcement the digital bond worth 113 million will come with a six-month maturity and a coupon rate of 06 per annum. UOB this month also piloted a digital issuance. DBS Bank will issue digital bonds with a maturity of 6 months and an annualized coupon rate of 06 through its Digital Exchange DDEx. And DBS Bank is the only book-runner for this transaction.

Source: pinterest.com

Source: pinterest.com

Multinational Singapore-based bank DBS has issued a S15 million US113 million digital bond in its first security token offering STO. DBS is reportedly the sole bookrunner for the. The DBS digital bond has been priced at 1135 million and comes with a six-month tenor and coupon rate of 060 annually. Multinational bank DBS has issued S 15 million 113 million digital bonds in its first share token offering STO through its own Digital Exchange. DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond.

Source: bloomberg.com

Source: bloomberg.com

For more information please visit. Unlike the traditional public bond development approach this digital bond issuance was completed by private placement. This marks the first Security Token Offering STO on the digital exchange. Here are some details of the DBS digital bond. The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of 10000 - a significantly smaller denomination compared with.

Source: finansial.bisnis.com

Source: finansial.bisnis.com

The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of S10000 - a significantly smaller denomination compared to traditional wholesale bonds which typically require investment and trading amounts in. DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond. The DBS digital bond which has come with a six-month tenor and coupon rate of 060 per annum was carried out through a private placement. The offering was carried out through a private placement hosted by DBS Digital. The DBS Digital Bond which is issued via DDEx comes with a six-month expiry and a coupon rate of 060 per annum.

Source: dbs.id

Source: dbs.id

Today Singapores DBS Bank announced it has priced its first blockchain digital bond on the DBS Digital Exchange DDEx. In the US they are called Treasury Bonds. For the next phase of development issuers will be able to issue self-led digital bonds which can be listed on the DBS Digital Exchange DDEx to provide corporates an alternate investor base to tap capital markets for their business and growth ambitions. For the next phase of development issuers will be able to issue self-led digital bonds which can be listed on the DBS Digital Exchange DDEx to provide corporates an alternate investor base to tap capital markets for their business and growth ambitions. Launched in December DBS Digital Exchange leverages blockchain technology to provide tokenization trading and custody for digital assets.

Source: blockchain.news

Source: blockchain.news

The DBS Digital Bond which is issued via DDEx comes with a six-month expiry and a coupon rate of 060 per annum. In addition to the digital bond the exchange supports trades between four fiat currencies SGD USD HKD JPY and four cryptocurrencies Bitcoin Ether Bitcoin Cash XRP. As with other security token offering platforms launched by institutions the first bond raises a relatively small amount of funds for DBS itself. The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of S10000 - a significantly smaller denomination compared to traditional wholesale bonds which typically require investment and trading amounts in. The SGD 15 million 11m DBS Digital Bond has a six-month maturity carries a 06.

Source: pinterest.com

Source: pinterest.com

Singapore-based multinational banking corporation DBS Bank has launched its first-ever security token offering or STO by issuing a digital bond. According to a press release shared with CoinDesk on Monday the DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon of 06 per annum. The DBS Digital Bond which comes with a six-month tenor and coupon rate of 06 per cent per annum will be traded in board lots of S10000 - a significantly smaller denomination compared to traditional wholesale bonds which typically require investment and trading amounts in. The DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon rate of 06 per annum. This marks the first Security Token Offering STO on the digital exchange.

According to a press release shared with CoinDesk on Monday the DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon of 06 per annum. The digital bond will trade in Singapore for a whopping S10000 7600. Multinational Singapore-based bank DBS has issued a. The DBS Digital Bond which is issued via DDEx comes with a six-month expiry and a coupon rate of 060 per annum. The bonds expire in six months and pay out 060 a year.

Source: marketing.co.id

Source: marketing.co.id

As with other security token offering platforms launched by institutions the first bond raises a relatively small amount of funds for DBS itself. The latest bond strictly adheres to the bond legal framework. The bonds expire in six months and pay out 060 a year. DBS Bank Southeast Asias largest lender by assets launched this week its first security token offering STO a S15 million US11 million digital bond. On 31 May 2021 DBS the largest bank in Singapore launched a S15 million digital bond on the DBS Digital Exchange by private placement.

Source: mobile.twitter.com

Source: mobile.twitter.com

According to a press release shared with CoinDesk on Monday the DBS Digital Bond issued via its Digital Exchange DDEx has a sixth-month expiry and a coupon of 06 per annum. DBS is reportedly the sole bookrunner for the. Government bonds in Singapore are known as Singapore Savings Bonds. On Monday the DBS bank announced its launch of the first digital security offering on DBS Digital Exchange DDEx. Multinational bank DBS has issued S 15 million 113 million digital bonds in its first share token offering STO through its own Digital Exchange.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title dbs digital bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- 44++ 2 dollars in rupees Top

- 17+ 1 sgd to idr List

- 33++ Cyber currency wallet Trading

- 50++ Win coinmarketcap Stock

- 43+ Digital asset management software open source Coin

- 49++ Decentralized crypto exchanges Trading

- 23++ Pinkcoin exchanger Bitcoin

- 27++ Pi digital currency price Popular

- 47+ Crypto currency link Bitcoin

- 20+ Binance fees explained Popular